Table of Contents

ToggleIn the race to secure climate-resilient, sustainable investments, few frontiers are as promising—or as overlooked—as tropical agribusiness. The lush landscapes of Suriname, nestled on South America’s northern coast, offer a compelling case for how Environmental, Social, and Governance (ESG) frameworks can not only de-risk agricultural ventures but also unlock new markets and build long-term value.

Suriname’s nascent agribusiness sector is writing a new ESG playbook—one that can guide investors, policymakers, and entrepreneurs across the Global South. This article explores how ESG principles are shaping tropical agriculture in Suriname, the results so far, and how these lessons can inform scalable, profitable ventures in similar contexts.

I. Suriname: A Hidden Jewel in Sustainable Agriculture

An Untapped Green Powerhouse

Suriname is one of the world’s most forested countries, with over 93% of its land covered by tropical rainforest. Historically dependent on extractive industries like gold and bauxite, agriculture has only recently emerged as a serious player in the nation’s economic diversification strategy.

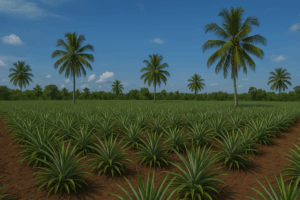

Yet, the potential is enormous. The country enjoys fertile soils, abundant freshwater resources, and a strategic location near European and North American markets. Recent years have seen a wave of investment in tropical crops such as rice, cassava, citrus, and plantains—many of which align with organic and regenerative agriculture trends.

The shift isn’t accidental. Suriname’s government has prioritized sustainable agriculture in its Green Growth Strategy 2030, positioning it as both a food security measure and a climate mitigation tool. And at the core of this strategy is ESG.

II. Environmental: Climate-Resilient Farming That Regenerates

Regenerative Agriculture and Forest Conservation

Suriname faces a double mandate: increase agricultural output while protecting its vast rainforest reserves. The country has responded by promoting regenerative agricultural practices—no-till farming, cover cropping, composting, and agroforestry.

One standout initiative is the Paramacca Agro-Initiative, a farmer-led cooperative focused on cassava and plantain cultivation. By integrating leguminous shade trees and native grasses, they have enhanced soil fertility, sequestered carbon, and reduced fertilizer use by 45%. Independent assessments estimate the initiative sequesters approximately 2.5 tons of CO₂ per hectare annually.

Water Management in a Warming Climate

Tropical agriculture depends heavily on rainfall, but climate variability is increasing flood and drought risks. Suriname’s low-lying coastal plains are particularly vulnerable. To address this, ESG-driven agribusinesses are leveraging smart water technologies.

The Saramacca Irrigation Pilot introduced solar-powered drip systems and digital soil moisture sensors, slashing water waste by 40% and boosting yields by 30% over two growing seasons. These climate-smart approaches are now central to national ESG benchmarks for agriculture.

Organic and Low-Input Systems

With growing global demand for organic produce, Suriname’s low-input farming traditions are an asset. Several cooperatives are transitioning toward organic certification, aided by international partners. One such group, the Tapanahony Agro Cooperative, recently launched a certified organic turmeric line for export to European health food retailers, commanding a 25% price premium over conventional crops.

III. Social: Empowerment, Equity, and Community-Led Development

Inclusion of Indigenous and Maroon Communities

One of Suriname’s defining social strengths is its cultural diversity, including Indigenous and Maroon (descendants of escaped African slaves) populations. These communities possess rich agroecological knowledge and land stewardship practices.

Forward-thinking agribusinesses are shifting from extractive to participatory models. The Upper Suriname Valley Cocoa Project employs a benefit-sharing structure where local communities own 40% equity in the operation. In just two years, average household incomes increased by 22%, and school attendance among children improved markedly.

Gender Equity in Agribusiness

In many rural areas, women are the backbone of agricultural labor but remain locked out of land ownership and credit. Suriname is changing this narrative through gender-focused ESG initiatives. A collaboration between the IDB Lab and local NGOs launched the AgriWomen Microfund, offering collateral-free loans and agronomic training to women-led farms.

The impact is measurable: more than 150 women have secured financing, and participating farms have reported a 33% increase in productivity. These programs are also reshaping investor narratives—gender-inclusive ventures are showing stronger financial performance and better community relations.

Youth Engagement and Agritech

Rural youth migration is a growing concern, but ESG-driven agribusiness is pulling them back through technology. A new agri-accelerator in Paramaribo offers training in drone mapping, climate data analytics, and app-based crop management. Young graduates are now leading ventures in greenhouse vegetable farming and aquaponics—turning agriculture into an aspirational sector.

IV. Governance: Traceability, Transparency, and Trust

Blockchain-Powered Supply Chains

Global buyers are demanding traceability and accountability, especially in tropical produce markets. Suriname is ahead of the curve with its pilot blockchain ledger for organic rice, led by a joint venture between the Suriname Agricultural Board and Dutch tech startup AgriLedger.

Each transaction, from planting to export, is logged on-chain. Farmers receive instant mobile payments upon delivery, and buyers in the EU can trace their rice to individual fields. Transaction costs have dropped by 12%, and fraud complaints have nearly disappeared.

Certification and Compliance

Governance in ESG goes beyond tech. Suriname is aligning its national certification standards with GlobalG.A.P. and Rainforest Alliance, providing exporters with smoother access to premium markets. The Ministry of Agriculture has established an ESG Compliance Desk to help SMEs navigate certification processes.

These efforts not only boost investor confidence but also increase Suriname’s competitiveness in high-value export segments like organic citrus, herbal teas, and exotic spices.

V. The Investment Case for ESG-Driven Agribusiness

Risk-Adjusted Returns in Emerging Markets

Tropical agribusiness, when structured with ESG safeguards, offers investors a compelling value proposition. By integrating environmental resilience, community engagement, and transparent governance, these ventures reduce political, operational, and climate risks.

Suriname’s ESG projects demonstrate:

-

Lower default rates on microloans (<5%)

-

Higher net yields on regeneratively grown crops

-

Improved market access through ESG certifications

-

Lower cost of capital for ventures with third-party ESG ratings

Carbon Credits and Dual Revenue Models

With increasing interest in natural capital and carbon markets, agribusinesses that sequester carbon or protect biodiversity are unlocking new revenue streams. The Saamaka Forest Agro Cooperative registered 1,200 hectares of agroforestry under the Verra carbon standard and anticipates $500,000 annually in carbon offset sales.

Investors gain dual exposure: agricultural ROI plus carbon-linked dividends—a model that aligns with emerging climate finance trends.

Premium Markets and Consumer Demand

Suriname’s ESG-compliant products—such as organic bananas, turmeric, and non-GMO rice—are now featured in European and North American specialty stores. Demand for ethical, traceable produce is growing, especially in urban centers where sustainability influences purchasing decisions.

Retailers in Amsterdam and Berlin have expressed interest in Surinamese cocoa beans due to the direct-trade, ESG-verified model. The price premiums range from 15% to 35%, enhancing overall profitability.

VI. Lessons and Levers for Scaling the Suriname Model

Suriname’s ESG approach offers a replicable roadmap, but scaling requires coordinated action across multiple stakeholders.

Blended Finance as a Catalyst

De-risking early-stage agribusiness is essential. Blended finance vehicles—combining concessional capital from DFIs with commercial equity—can bridge the gap. Suriname’s Green Agrifund is already piloting this model, with plans to expand regionally.

ESG Technical Assistance

Certification is a major barrier for smallholders. Partnering with NGOs and ESG consulting firms to offer technical assistance can help local agribusinesses meet international benchmarks. This, in turn, attracts impact-focused investors seeking alignment with SDGs and Paris-aligned portfolios.

Regional Knowledge Sharing

Suriname has begun exchanging ESG best practices with Guyana, Trinidad, and Brazil. These collaborations create learning loops for climate-smart innovation, indigenous rights, and biodiversity-based enterprise. Creating a regional ESG alliance could elevate the entire Caribbean basin as a green investment hub.

VII. Final Thoughts: Cultivating a Sustainable Future

Suriname is doing more than planting crops—it’s planting a vision for how tropical nations can lead the ESG transformation in agriculture. Its success isn’t rooted in large-scale industrial farms but in inclusive, regenerative systems that align ecological protection with economic empowerment.

For investors, development agencies, and policymakers, Suriname’s experience is a call to action. The future of agriculture isn’t in the global north—it’s in places like the Amazon basin, the Congo rainforest, and the Mekong Delta. And it begins with ESG.

If we are serious about building climate-resilient food systems, protecting biodiversity, and creating dignified livelihoods, then we must look to models like Suriname—not just as inspiration, but as the foundation for the next generation of investment in the tropics.

Join Bottom Billion Corporation in Driving ESG Innovation

At Bottom Billion Corporation, we’re not just observing the ESG revolution—we’re engineering it on the ground. From climate-resilient farming to inclusive value chains, we partner with local communities, forward-thinking investors, and government allies to scale agribusiness that works for people and planet.

If you’re ready to invest in the future of tropical agriculture—and help write the next chapter in sustainability—join us on our projects in Suriname and across the Global South. Together, we can turn regenerative ambition into profitable, measurable impact.

Reach out today to explore how you can partner with Bottom Billion Corporation.